Unlocking Financial Success with Professional Book Keeping and Accounting Services

In today's dynamic business environment, effective financial management is crucial for success. Companies of all sizes are turning to book keeping and accounting services to streamline their operations, providing them with the clarity and control necessary to thrive. This article explores the myriad benefits of these services, the essential roles they play in financial planning, and how you can leverage them for your business's growth.

Understanding Book Keeping and Accounting Services

At its core, book keeping involves the systematic recording, organizing, and storing of financial transactions. It provides the foundational data required for informed financial decision-making. Conversely, accounting encompasses broader financial analysis, reporting, and strategic planning. Both functions are critical for maintaining accurate financial health and ensuring compliance with laws and regulations.

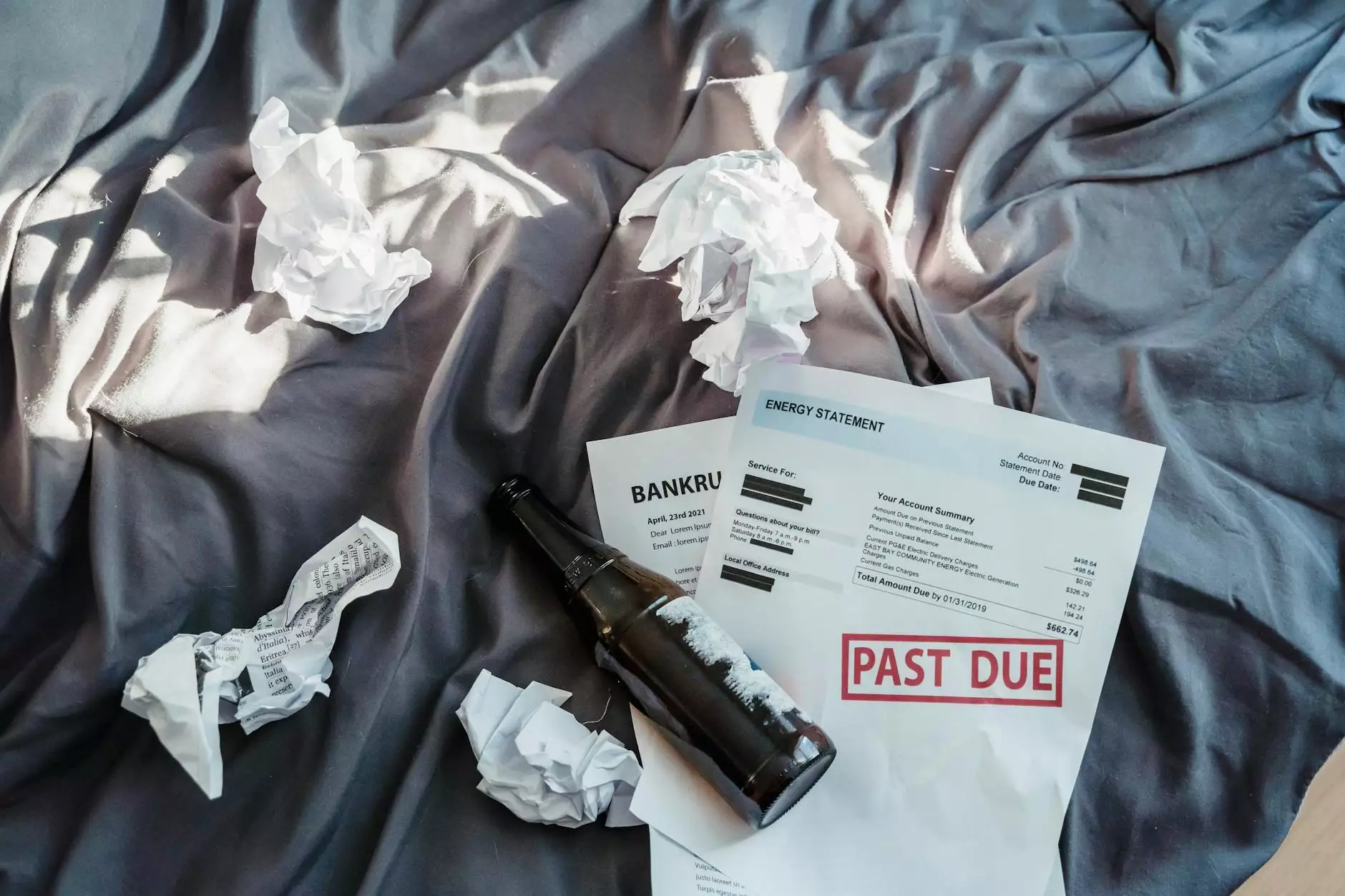

The Importance of Book Keeping in Business

Every successful business begins with accurate book keeping. It equips businesses with the following advantages:

- Improved Accuracy: Diligent book keeping reduces errors in financial records, which can lead to costly mistakes down the line.

- Time-Saving: Automated book keeping frees up valuable time for business owners, allowing them to focus on core activities.

- Regulatory Compliance: Regularly updated books ensure compliance with local laws, helping to avoid fines and legal issues.

- Enhanced Financial Reporting: With precise records, businesses can generate insightful financial reports that guide strategy.

The Role of Accounting in Financial Management

While book keeping lays the groundwork, robust accounting services offer strategic insights that propel businesses forward:

- Financial Analysis: Accountants analyze trends and variances in financial data to offer actionable insights.

- Tax Planning and Compliance: Effective accountants navigate tax regulations, ensuring compliance while maximizing savings.

- Budgeting and Forecasting: Accountants help businesses plan for the future by creating accurate budgets and financial forecasts.

- Investment Advising: Accounting professionals provide guidance on investments that align with financial goals.

Why Choose Professional Book Keeping and Accounting Services?

Outsourcing your book keeping and accounting services to professionals like those at Booksla.com offers numerous benefits:

1. Expertise and Experience

Hiring professionals ensures that your financial records are managed by individuals with expert knowledge and years of experience, providing you with peace of mind.

2. Cost-Effectiveness

Outsourcing is often more cost-effective than maintaining an in-house accounting department. You save on salaries, benefits, and training costs while gaining access to high-quality services.

3. Scalability

As your business grows, your financial management needs evolve. Professional services can adapt accordingly, offering scalable solutions that grow with you.

4. Focus on Core Business Activities

With professionals handling your book keeping and accounting, you can devote more time and resources to your primary business functions, enhancing productivity.

Key Services Offered in Book Keeping and Accounting

Understanding the specific services available can help you choose the right package for your needs. Here are some essential offerings commonly found in book keeping and accounting services:

1. Monthly Financial Statement Preparation

Timely financial statements are crucial for assessing the financial position of your business. They provide insights into your earnings and expenditures and help identify trends.

2. Accounts Payable and Receivable Management

Efficient management of accounts receivable and payable ensures that your cash flow remains healthy. Professionals keep track of your debts and credits, maintaining accurate records.

3. Payroll Processing

Outsourcing payroll processing not only ensures accuracy in calculations but also guarantees compliance with labor laws.

4. Tax Preparation and Filing

Tax laws can be complex. Professional accountants ensure that your taxes are prepared accurately and filed on time, minimizing overall tax liability.

5. Financial Planning and Advising

Strategic financial planning is essential for sustainable growth. Accountants offer tailored advice based on detailed financial analysis.

Adapting to Changes in Technology

Modern technology has transformed the landscape of book keeping and accounting services. Here are some benefits of embracing technology in financial management:

- Cloud Accounting: Access your financial data from anywhere and at any time with secure cloud solutions.

- Automation: Routine tasks, such as invoicing and data entry, are automated, reducing the risk of error.

- Real-Time Tracking: Gain insights into your financial position in real time, allowing for timely decision-making.

- Integration: Seamless integration with other business software enhances efficiency across operations.

Real-Life Case Studies: The Impact of Professional Services

Understanding the real-world benefits of book keeping and accounting services can significantly help business owners see their value. Here are a few case studies:

Case Study 1: Small Business Growth

A small local retail shop struggled with cash flow management due to inconsistent sales tracking. By transitioning to professional book keeping and accounting services, they achieved accurate records and timely financial analysis. Within a year, their revenue grew by 30% as they implemented strategic business decisions based on informed reports.

Case Study 2: Tax Savings for Medium Enterprises

A medium-sized tech startup faced exorbitant tax liabilities due to improper filing methods. By engaging with experienced accountants, they not only ensured compliance but also identified eligible deductions they were previously unaware of. Over the course of their partnership, they saved over $50,000 in taxes.

Choosing the Right Provider for Book Keeping and Accounting Services

When it comes to selecting a service provider such as Booksla.com, there are several factors to consider:

1. Reputation and Reviews

Look for companies with excellent client reviews and a proven track record. Testimonials, case studies, and ratings offer insights into reliability.

2. Range of Services

Choose a provider that offers a comprehensive range of services, ensuring all your financial needs are met under one roof.

3. Transparency in Pricing

Ensure that the pricing structure is clear. You should fully understand what you will be paying for without hidden fees.

4. Customized Solutions

Every business is unique. Opt for a service that tailors its offerings to suit your specific industry needs and challenges.

The Future of Book Keeping and Accounting: Trends to Watch

The world of book keeping and accounting services is evolving. Here are some key trends shaping the future:

- Artificial Intelligence: AI is automating repetitive tasks and enhancing forecasting accuracy.

- Data Analytics: Enhanced data analysis tools are helping businesses drive more informed decisions.

- Virtual Accountants: Remote accounting services are becoming the norm, providing businesses with flexible, scalable options.

- Blockchain Technology: This technology is ensuring transparency and security in financial transactions.

Conclusion: Elevate Your Business with Superior Book Keeping and Accounting Services

In conclusion, integrating professional book keeping and accounting services into your business model is not merely a choice; it is a necessity for sustainable growth and financial success. Partnering with experts, such as those found at Booksla.com, allows businesses to unlock their full potential, ensuring financial health while enabling owners to focus on what they do best. Take the next step and invest in your business’s future today!